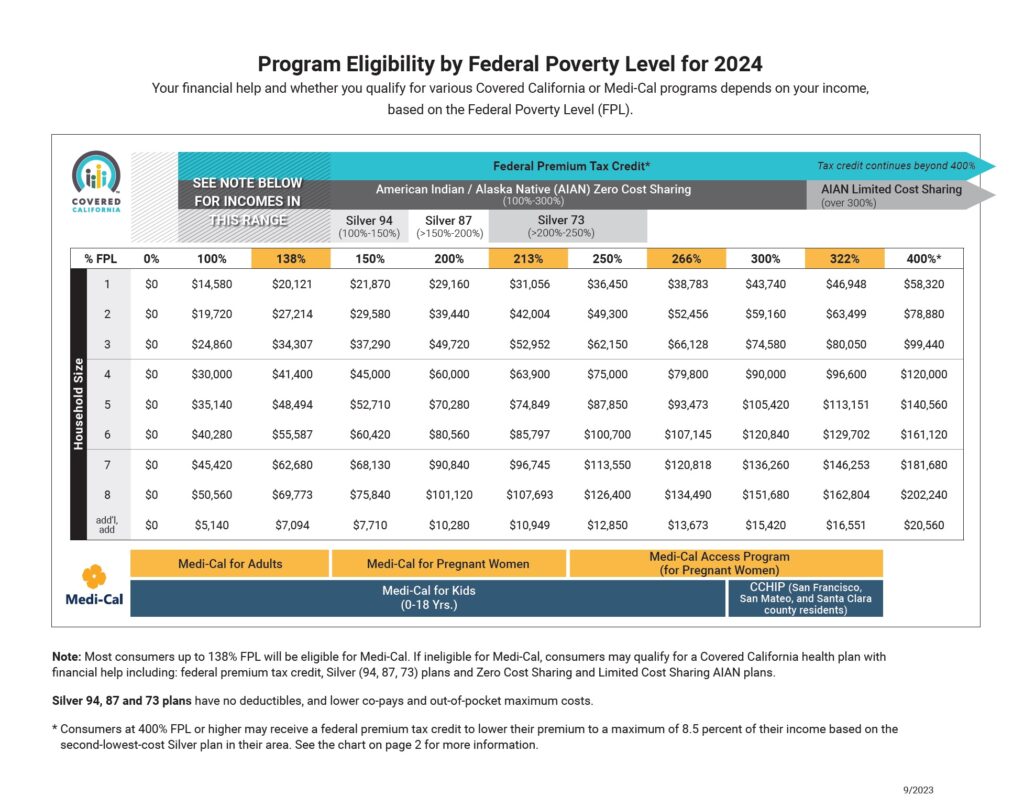

Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance. It is issued every year by the Department of Health and Human Services (HHS).

How federal poverty levels are used to determine eligibility for reduced-cost health coverage

According the healthcare.gov

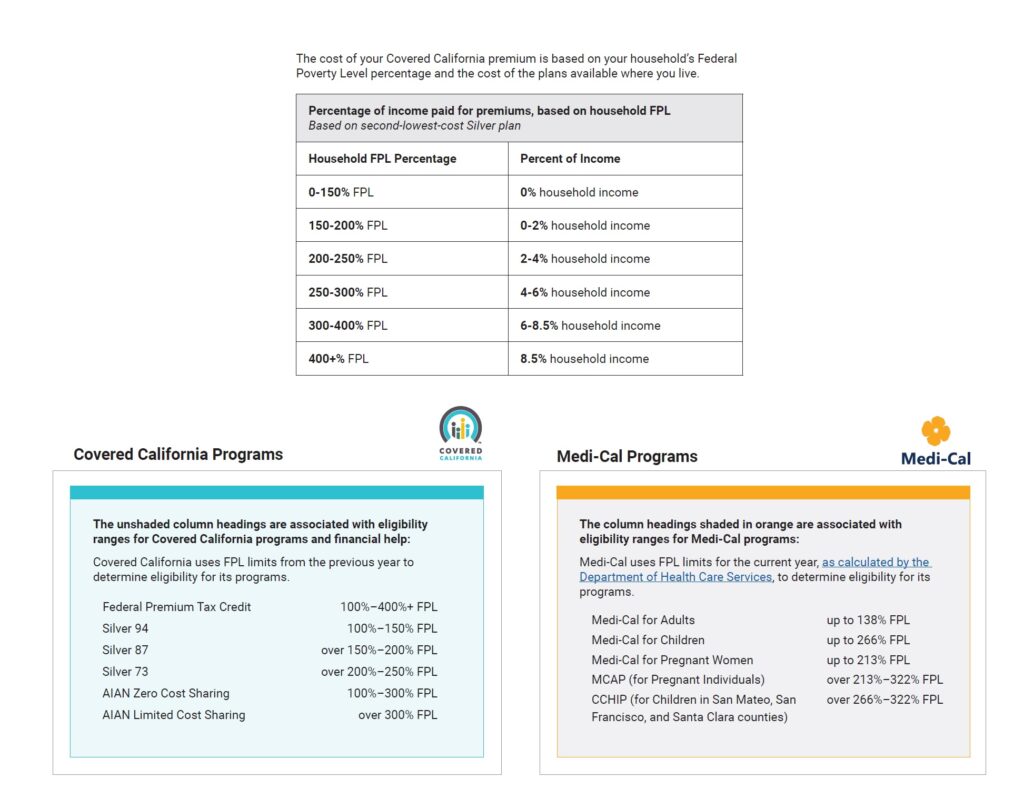

• Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2023 Marketplace health insurance plan.

• Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.

• Income at or below 150% FPL: If your income falls at or below 150% FPL in your state and you’re not eligible for Medicaid or CHIP, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

• Income below 138% FPL: If your income is below 138% FPL and your state has expanded Medicaid coverage, you qualify for Medicaid based only on your income.

• Income below 100% FPL: If your income falls below 100% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan or for income-based Medicaid.

“Income” above refers to “modified adjusted gross income” (MAGI)

. For most people, it’s the same or very similar to

“adjusted gross income” (AGI) . MAGI isn’t a number on your tax return.

How do you calculate AGI?

Your adjusted gross income is all of the income you bring in, minus certain adjustments. You can find the allowable reductions to your income on the front page of your Form 1040.

Commonly used adjustments include the following:

• IRA and self-employed retirement plan contributions

• Alimony payments (for divorce agreements prior to 2019)

• Self-employed health insurance payments

• One-half of any self-employment taxes paid

Other adjustments used in calculating AGI include the following:

• Health savings account deductions

• Penalties on the early withdrawal of savings

• Educator expenses

• Student loan interest

• Moving expenses (for tax years prior to 2018)

• Tuition and fees

• Deductions for domestic production activities (for tax years prior to 2018)

• Certain business expenses of performing artists, reservists, and fee-basis government officials

How do you calculate MAGI?

To calculate your modified adjusted gross income, take your AGI and “add-back” certain deductions.

According to the IRS, your MAGI is your AGI with the addition of the appropriate deductions, potentially including:

• Student loan interest

• One-half of self-employment tax

• Qualified tuition expenses

• Tuition and fees deduction

• Passive loss or passive income

• IRA contributions

• Non-taxable social security payments

• The exclusion for income from U.S. savings bonds

• Foreign earned income exclusion

• Foreign housing exclusion or deduction

• The exclusion under 137 for adoption expenses

• Rental losses

• Any overall loss from a publicly traded partnership